SOLUTIONS TO SELF-CHECK QUESTION

5.1 How Individuals Make Choices Based on Their Budget Constraints

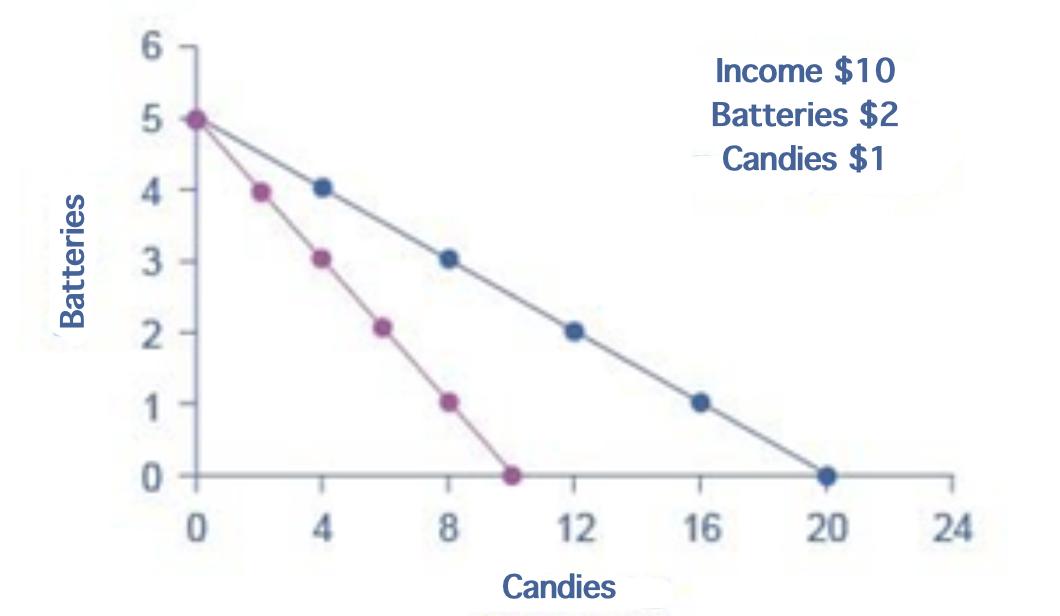

- The opportunity cost of candy is the number of batteries that must be given up to obtain one more piece of candy. Originally, when the price of candy was 50 cents, this opportunity cost was .50/2 = .25 candy. The reason for this is that at the original prices, one battery ($2) costs the same as four pieces of candy ($0.50), so the opportunity cost of a battery is four pieces of candy, and the opportunity cost of a piece of candy is .25 (the inverse of the opportunity cost of a battery). With the new, higher price of candy, the opportunity cost rises to $1/$2 or .50. You can see this graphically since the slope of the new budget constraint is flatter than the original one. If you spend your entire budget on batteries, the higher price of candy has no impact so the horizontal intercept of the budget constraint is the same. If he spends his entire budget on candy, he can now afford only half as many, so the vertical intercept is half as much. In short, the budget constraint rotates clockwise around the horizontal intercept, flattening as it goes. Since the slope of the budget constraint reflects the opportunity cost of whatever good is on the vertical axis (in this case, candy) the opportunity cost of candy increases.

- Both the budget constraint and the PPF show the constraint that each operates under. Both show a tradeoff between having more of one good but less of the other. Both show the opportunity cost graphically as the slope of the constraint (budget or PPF).

- When individuals compare cost per unit in the grocery store, or characteristics of one product versus another, they are behaving approximately like the model describes.

5.2 Consumption Choices

- Utility is a subjective value determined by one’s own preferences.

- Total utility generally rises with consumption of a good, because even if the extra goods are unwanted, they can always be sold or traded for something else.

- Marginal utility tends to fall with additional consumption, because we value the first unit more than the second and so on. This is diminishing marginal returns.

5.3 How Changes in Income and Prices Affect Consumption Choices

- This is the opposite of the example explained in the text. A decrease in price has a substitution effect and an income effect. The substitution effect says that because the product is cheaper relative to other things the consumer purchases, he or she will tend to buy more of the product (and less of the other things). The income effect says that after the price decline, the consumer could purchase the same goods as before, and still have money left over to purchase more. For both reasons, a decrease in price causes an increase in quantity demanded.

- This is a negative income effect. Because your parents’ check failed to arrive, your monthly income is less than normal and your budget constraint shifts in toward the origin. If you only buy normal goods, the decrease in your income means you will buy less of every product.