14.3 The Safety Net

Learning Objectives

By the end of this section, you will be able to:

- Identify the antipoverty government programs that comprise the safety net

- Explain the the safety net programs’ primary goals and how these programs have changed over time

- Discuss the complexities of these safety net programs and why they can be controversial

The U.S. government has implemented a number of programs to assist those below the poverty line and those who have incomes just above the poverty line, to whom we refer as the near-poor. Such programs are called the safety net, to recognize that they offer some protection for those who find themselves without jobs or income.

Temporary Assistance for Needy Families

From the Great Depression until 1996, the United States’ most visible antipoverty program was Aid to Families with Dependent Children (AFDC), which provided cash payments to mothers with children who were below the poverty line. Many just called this program “welfare.” In 1996, Congress passed and President Bill Clinton signed into law the Personal Responsibility and Work Opportunity Reconciliation Act, more commonly called the “welfare reform act.” The new law replaced AFDC with Temporary Assistance for Needy Families (TANF).

LINK IT UP

Welfare and Politics of Poverty addressing the major shift from AFDC to TANF. Watch this YouTube video created by the New York Times for more information on this issue.

TANF brought several dramatic changes in how welfare operated. Under the old AFDC program, states set the level of welfare benefits that they would pay to the poor, and the federal government guaranteed it would chip in some of the money as well. The federal government’s welfare spending would rise or fall depending on the number of poor people, and on how each state set its own welfare contribution.

Under TANF, however, the federal government gives a fixed amount of money to each state. The state can then use the money for almost any program with an antipoverty component: for example, the state might use the money to give cash to poor families, or to reduce teenage pregnancy, or even to raise the high school graduation rate. However, the federal government imposed two key requirements. First, if states are to keep receiving the TANF grants, they must impose work requirements so that most of those receiving TANF benefits are working (or attending school). Second, no one can receive TANF benefits with federal money for more than a total of five years over their lifetime. The old AFDC program had no such work requirements or time limits.

TANF attempts to avoid the poverty trap by requiring that welfare recipients work and by limiting the length of time they can receive benefits. In its first few years, the program was quite successful. The number of families receiving payments in 1995, the last year of AFDC, was 4.8 million. By 2012, according to the Congressional Research Service, the average number of families receiving payments under TANF was 1.8 million—a decline of more than half.

TANF benefits to poor families vary considerably across states. For example, again according to the Congressional Research Service, in 2011 the highest monthly payment in Alaska to a single mother with two children was $923, while in Mississippi the highest monthly payment to that family was $170. These payments reflect differences in states’ cost of living. Total spending on TANF was approximately $16.6 billion in 1997. As of 2012, spending was at $12 billion, an almost 28% decrease, split about evenly between the federal and state governments. When you take into account the effects of inflation, the decline is even greater. Moreover, there seemed little evidence that poor families were suffering a reduced standard of living as a result of TANF—although, on the other side, there was not much evidence that poor families had greatly improved their total levels of income, either.

The Earned Income Tax Credit (EITC)

The earned income tax credit (EITC), first passed in 1975, is a method of assisting the working poor through the tax system. The EITC is one of the largest assistance program for low-income groups, and in the 2016 tax year, an estimated 27 million households took advantage of it at an estimated cost of $66 billion. In 2019, for example, a single parent with two children would have received a tax credit of $5,828 up to an income level of $19,030. The amount of the tax break increases with the amount of income earned, up to a point. The earned income tax credit has often been popular with both economists and the general public because of the way it effectively increases the payment received for work.

What about the danger of the poverty trap that every additional $1 earned will reduce government support payments by close to $1? To minimize this problem, the earned income tax credit is phased out slowly. According to the Tax Policy Center, for a single-parent family with two children in 2019, the credit is not reduced at all (but neither is it increased) as earnings rise from $14,570 to $19,030. Then, for every $1 earned above $19,030, the amount received from the credit is reduced by 21.06 cents, until the credit phases out completely at an income level of $46,703.

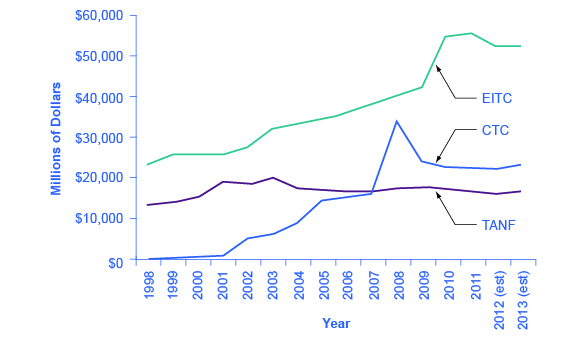

Figure 14.5 illustrates that the earned income tax credits, child tax credits, and the TANF program all cost the federal government money—either in direct outlays or in loss of tax revenues. CTC stands for the government tax cuts for the child tax credit.

In recent years, the EITC has become a hugely expensive government program for providing income assistance to the poor and near-poor, costing about $66 billion in 2016. In that year, the EITC provided benefits to about 27 million families and individuals and, on average, is worth about $2,400 per family (with children), according to the Tax Policy Center. One reason that the TANF law worked as well as it did is that the government greatly expanded EITC in the late 1980s and again in the early 1990s, which increased the returns to work for low-income Americans.

Supplemental Nutrition Assistance Program (SNAP)

Often called “food stamps,” Supplemental Nutrition Assistance Program (SNAP) is a federally funded program, started in 1964, in which each month poor people receive a card like a debit card that they can use to buy food. The amount of food aid for which a household is eligible varies by income, number of children, and other factors but, in general, households are expected to spend about 30% of their own net income on food, and if 30% of their net income is not enough to purchase a nutritionally adequate diet, then those households are eligible for SNAP.

SNAP can contribute to the poverty trap. For every $100 earned, the government assumes that a family can spend $30 more for food, and thus reduces its eligibility for food aid by $30. This decreased benefit is not a complete disincentive to work—but combined with how other programs reduce benefits as income increases, it adds to the problem. SNAP, however, does try to address the poverty trap with its own set of work requirements and time limits.

Why give debit cards and not just cash? Part of the political support for SNAP comes from a belief that since recipients must spend the the cards on food, they cannot “waste” them on other forms of consumption. From an economic point of view, however, the belief that cards must increase spending on food seems wrong-headed. After all, say that a poor family is spending $2,500 per year on food, and then it starts receiving $1,000 per year in SNAP aid. The family might react by spending $3,500 per year on food (income plus aid), or it might react by continuing to spend $2,500 per year on food, but use the $1,000 in food aid to free up $1,000 that it can now spend on other goods. Thus, it is reasonable to think of SNAP cards as an alternative method, along with TANF and the earned income tax credit, of transferring income to the working poor.

Anyone eligible for TANF is also eligible for SNAP, although states can expand eligibility for food aid if they wish to do so. In some states, where TANF welfare spending is relatively low, a poor family may receive more in support from SNAP than from TANF. In 2018, 39.6 million people received food aid at an annual cost of about $60 billion, with an average monthly benefit of about $256 per household per month. SNAP participation increased by 70% between 2007 and 2011, from 26.6 million participants to 45 million. According to the Congressional Budget Office, the 2008-2009 Great Recession and rising food prices caused this dramatic rise in participation.

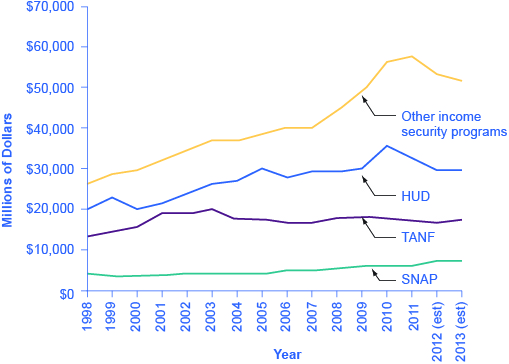

The federal government deploys a range of income security programs that it funds through departments such as Health and Human Services, Agriculture, and Housing and Urban Development (HUD) (see Figure 14.6). According to the Office of Management and Budget, collectively, these three departments provided an estimated $62 billion of aid through programs such as supplemental feeding programs for women and children, subsidized housing, and energy assistance. The federal government also transfers funds to individual states through special grant programs.

The safety net includes a number of other programs: government-subsidized school lunches and breakfasts for children from low-income families; the Special Supplemental Food Program for Women, Infants and Children (WIC), which provides food assistance for pregnant women and newborns; the Low Income Home Energy Assistance Program, which provides help with home heating bills; housing assistance, which helps pay the rent; and Supplemental Security Income, which provides cash support for the disabled and the elderly poor.

Medicaid

Congress created Medicaid in 1965. This is a joint health insurance program between both the states and the federal government. The federal government helps fund Medicaid, but each state is responsible for administering the program, determining the level of benefits, and determining eligibility. It provides medical insurance for certain low-income people, including those below the poverty line, with a focus on families with children, the elderly, and the disabled. About one-third of Medicaid spending is for low-income mothers with children. While an increasing share of the program funding in recent years has gone to pay for nursing home costs for the elderly poor. The program ensures that participants receive a basic level of benefits, but because each state sets eligibility requirements and provides varying levels of service, the program differs from state to state.

In the past, a common problem has been that many low-paying jobs pay enough to a breadwinner so that a family could lose its eligibility for Medicaid, yet the job does not offer health insurance benefits. A poor parent considering such a job might choose not to work rather than lose health insurance for their children. In this way, health insurance can become a part of the poverty trap. Many states recognized this problem in the 1980s and 1990s and expanded their Medicaid coverage to include not just the poor, but the near-poor earning up to 135% or even 185% of the poverty line. Some states also guaranteed that children would not lose coverage if their parents worked.

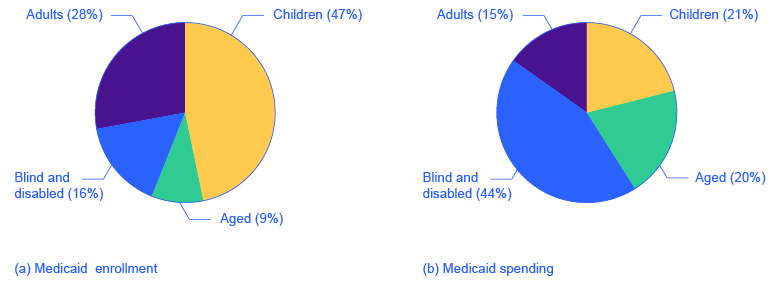

These expanded guarantees cost the government money, of course, but they also helped to encourage those on welfare to enter the labor force. As of 2019, approximately 72.4 million people participated in Medicaid. Of those enrolled, almost half are children. Healthcare expenditures, however, are highest for the elderly population, which comprises approximately 25% of participants. As Figure 14.7 (a) indicates, the largest number of households that enroll in Medicaid are those with children. Lower-income adults are the next largest group enrolled in Medicaid at 28%. The blind and disabled are 16% of those enrolled, and seniors are 9% of those enrolled. Figure 14.7 (b) shows how much actual Medicaid dollars the government spends for each group. Out of total Medicaid spending, the government spends more on seniors (20%) and the blind and disabled (44%). Thus, 64% of all Medicaid spending goes to seniors, the blind, and disabled. Children receive 21% of all Medicaid spending, followed by adults at 15%.

SELF-CHECK QUESTIONS

- We have discovered that the welfare system discourages recipients from working because the more income they earn, the less welfare benefits they receive. How does the earned income tax credit attempt to loosen the poverty trap?

- How does the TANF attempt to loosen the poverty trap?