3.3 Consumer Surplus, Producer Surplus, and Deadweight Loss

Learning Objectives

By the end of this section, you will be able to:

- Contrast consumer surplus, producer surplus, and social surplus

- Explain why price floors and price ceilings can be inefficient

The familiar demand and supply diagram holds within it the concept of economic efficiency. One typical way that economists define efficiency is when it is impossible to improve the situation of one party without imposing a cost on another. Conversely, if a situation is inefficient, it becomes possible to benefit at least one party without imposing costs on others.

Efficiency in the demand and supply model has the same basic meaning: The economy is getting as much benefit as possible from its scarce resources and all the possible gains from trade have been achieved. In other words, the optimal amount of each good and service is produced and consumed.

The demand and supply model emphasizes that prices are not only set by demand or supply, but also by the interaction between the two. In 1890, the famous economist Alfred Marshall wrote that asking whether supply or demand determined a price was like arguing “whether it is the upper or the under blade of a pair of scissors that cuts a piece of paper.” The answer is that both blades of the demand and supply scissors are always involved.

Consumer Surplus, Producer Surplus, Social Surplus

Consider a market for tablet computers, as Figure 3.9 shows. The equilibrium price is $80 and the equilibrium quantity is 28 million. To see the benefits to consumers, look at the segment of the demand curve above the equilibrium point and to the left. This portion of the demand curve shows that at least some demanders would have been willing to pay more than $80 for a tablet.

For example, point (J) shows that if the price were $90, 20 million tablets would be sold. Those consumers who would have been willing to pay $90 for a tablet (based on the utility they expect to receive from it) were able to pay the equilibrium price of $80, clearly received a benefit beyond what they had to pay. Remember, the demand curve traces consumers’ willingness to pay for different quantities. The amount that individuals would have been willing to pay, minus the amount that they actually paid, is called consumer surplus. Consumer surplus is the area labeled F—that is, the area above the market price and below the demand curve.

The supply curve shows the quantity that firms are willing to supply at each price. For example, point (K) in Figure 3.9 illustrates that, at $45, firms would still have been willing to supply a quantity of 14 million. Those producers who would have been willing to supply the tablets at $45, but who were instead able to charge the equilibrium price of $80, clearly received an extra benefit beyond what they required in order to supply the product. The amount that a seller is paid for a good minus the seller’s actual cost is called producer surplus. In Figure 3.9, producer surplus is the area labeled G—that is, the area between the market price and the segment of the supply curve below the equilibrium.

The sum of consumer surplus and producer surplus is social surplus, also referred to as economic surplus or total surplus. In Figure 3.9 we show social surplus as the area F + G. Social surplus is larger at equilibrium quantity and price than it would be at any other quantity. This demonstrates the economic efficiency of the market equilibrium. In addition, at the efficient level of output, it is impossible to produce greater consumer surplus without reducing producer surplus, and it is impossible to produce greater producer surplus without reducing consumer surplus.

Inefficiency of Price Floors and Price Ceilings

The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome. However, there is an additional twist here. Along with creating inefficiency, price floors and ceilings will also transfer some consumer surplus to producers, or some producer surplus to consumers.

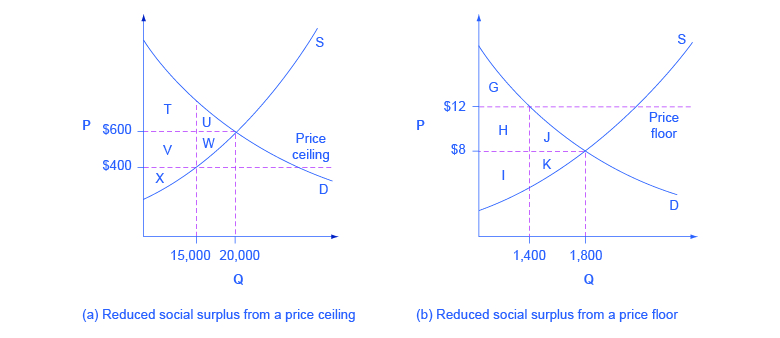

Imagine that several firms develop a promising but expensive new drug for treating back pain. If this therapy is left to the market, the equilibrium price will be $600 per month and 20,000 people will use the drug, as shown in Figure 3.10 (a). The original level of consumer surplus is T + U and producer surplus is V + W + X. However, the government decides to impose a price ceiling of $400 to make the drug more affordable. At this price ceiling, firms in the market now produce only 15,000.

As a result, two changes occur. First, an inefficient outcome occurs and the total surplus of society is reduced. The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. In a very real sense, it is like money thrown away that benefits no one. In Figure 3.10 (a), the deadweight loss is the area U + W. When deadweight loss exists, it is possible for both consumer and producer surplus to be higher, in this case because the price control is blocking some suppliers and demanders from transactions they would both be willing to make.

A second change from the price ceiling is that some of the producer surplus is transferred to consumers. After the price ceiling is imposed, the new consumer surplus is T + V, while the new producer surplus is X. In other words, the price ceiling transfers the area of surplus (V) from producers to consumers. Note that the gain to consumers is less than the loss to producers, which is just another way of seeing the deadweight loss.

Figure 3.10 (b) shows a price floor example using a string of struggling movie theaters, all in the same city. The current equilibrium is $8 per movie ticket, with 1,800 people attending movies. The original consumer surplus is G + H + J, and producer surplus is I + K. The city government is worried that movie theaters will go out of business, reducing the entertainment options available to citizens, so it decides to impose a price floor of $12 per ticket. As a result, the quantity demanded of movie tickets falls to 1,400. The new consumer surplus is G, and the new producer surplus is H + I. In effect, the price floor causes the area H to be transferred from consumer to producer surplus, but also causes a deadweight loss of J + K.

This analysis shows that a price ceiling, like a law establishing rent controls, will transfer some producer surplus to consumers—which helps to explain why consumers often favor them. Conversely, a price floor, like a guarantee that farmers will receive a certain price for their crops, will transfer some consumer surplus to producers, which explains why producers often favor them. However, both price floors and price ceilings block some transactions that buyers and sellers would have been willing to make, and creates deadweight loss. Removing such barriers, so that prices and quantities can adjust to their equilibrium level, will increase the economy’s social surplus.

SELF-CHECK QUESTIONS

- What is consumer surplus? How is it illustrated on a demand and supply diagram?

- What is producer surplus? How is it illustrated on a demand and supply diagram?

- What is total surplus? How is it illustrated on a demand and supply diagram?